- Bug Fixes

- Improved performance when using the app

- Bug fixes

- Improved performance when using the app

Added a new evaluation feature, improvements and bug fixes.

Bug fixes and performance improvements.

Bug fixes and performance improvements. This new version will ask for permission to access phone data. This app will use phone data exclusively to identify transmission failure.

Component update.

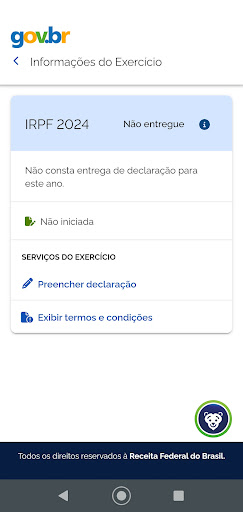

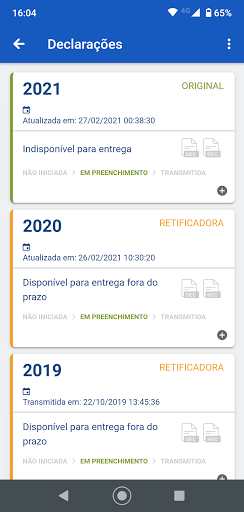

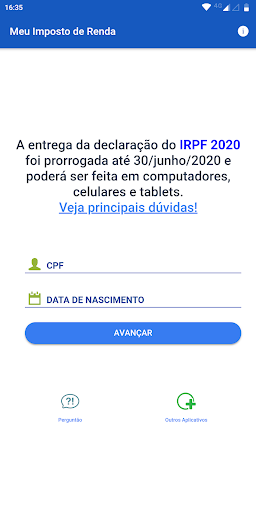

Extension of IRPF 2020 deadlines.

Component update

Component update

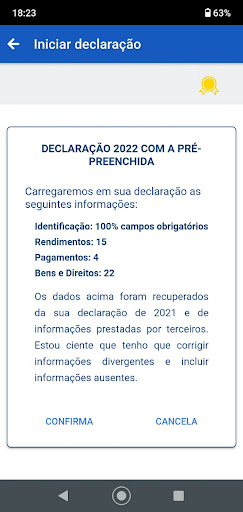

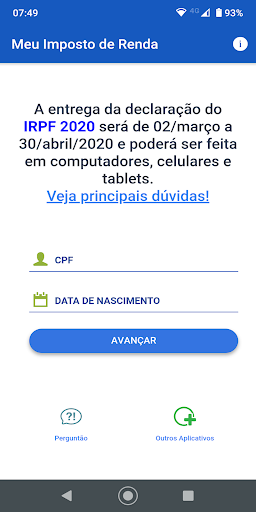

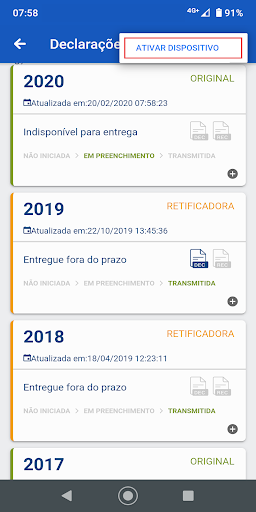

Updated to 2020!

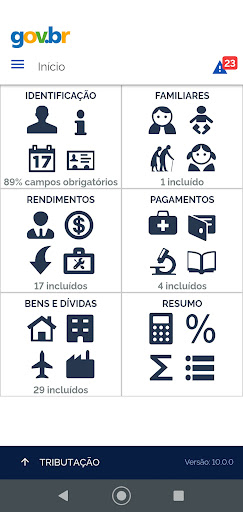

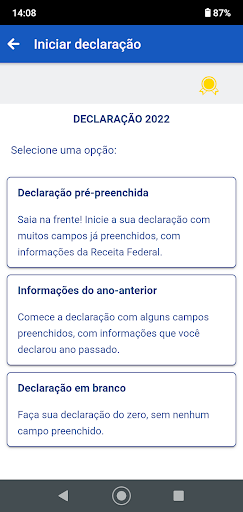

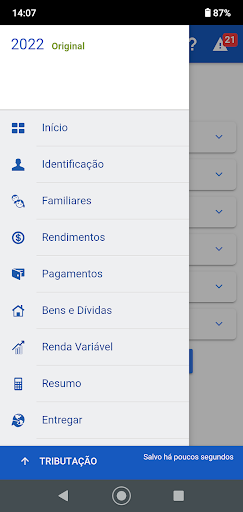

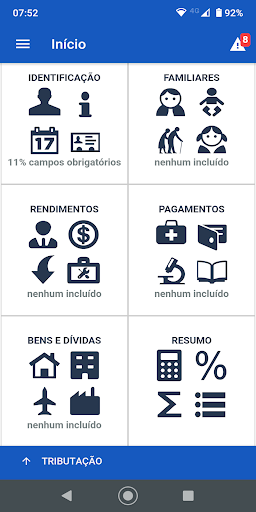

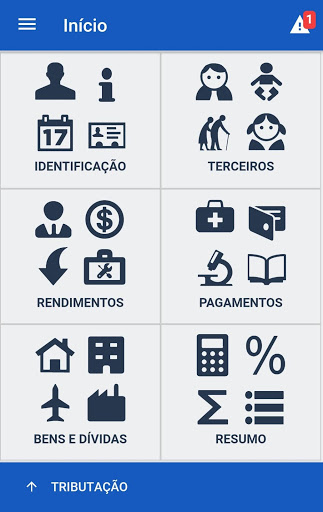

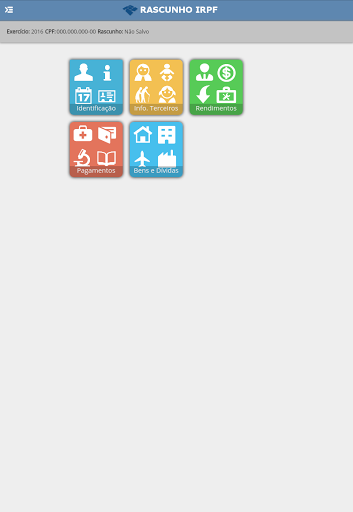

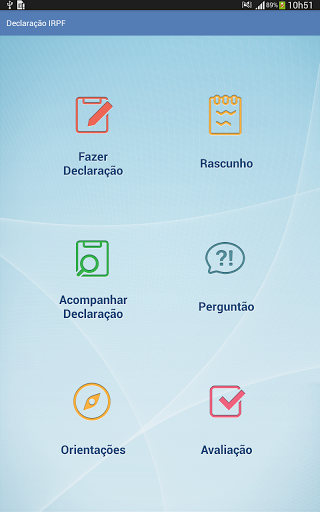

-Possibility to complete and deliver the 2020 declaration.

-Shortcuts for filling out the most common items.

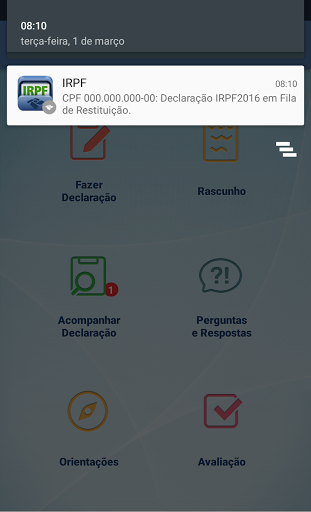

-Receiving alerts on the status of the declaration.

Correction of the fault in the call to the print service.

Settings for receiving notifications

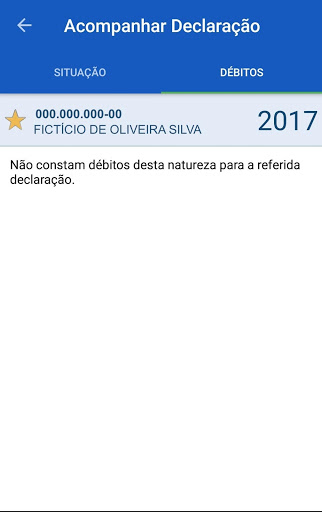

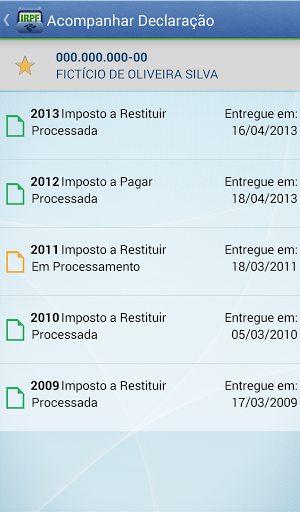

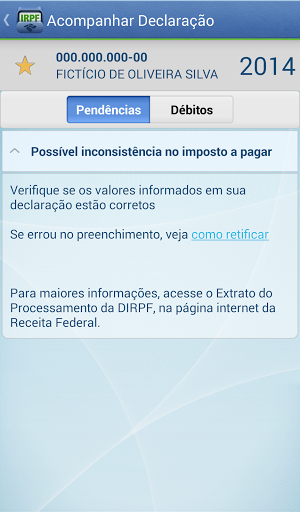

Possibility of access to the Extract of the Processing, to the Pendants of mesh and the emission of the DARF.

These features will only be available to taxpayers who:

- transmitted the declaration of the device itself and have access code generation conditions;

- registered the device in the mobile device registration (eCAC).

Correction of bugs that made it difficult to include income related to goods.

Corrected the error that prevented the issuance of DARF for donation to the Statute of the Child and Adolescent - ECA, when the result of the declaration was balance and tax payable - IAP or without balance of tax - SSI.

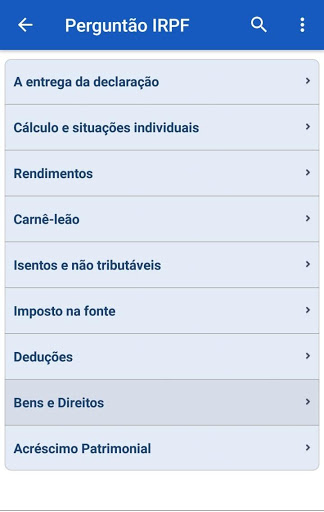

Inclusion of the Question 2019 and correction of bugs that, in some specific cases, made it difficult to fill out

Fixed failure to download the DEC and REC files of the transmitted statement.

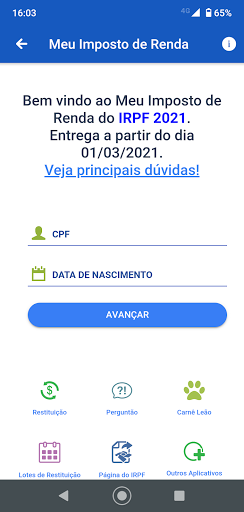

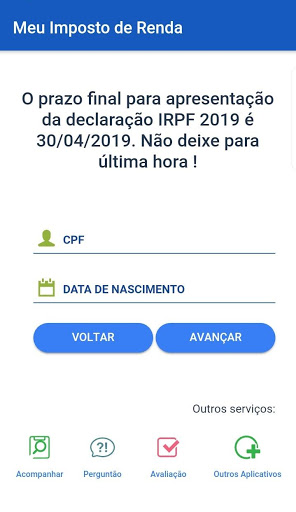

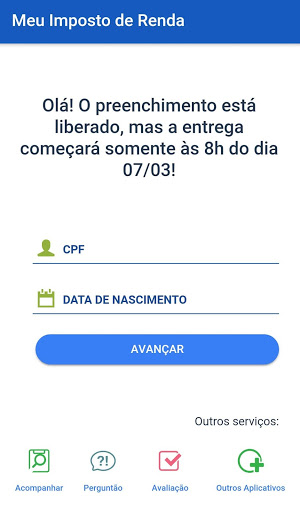

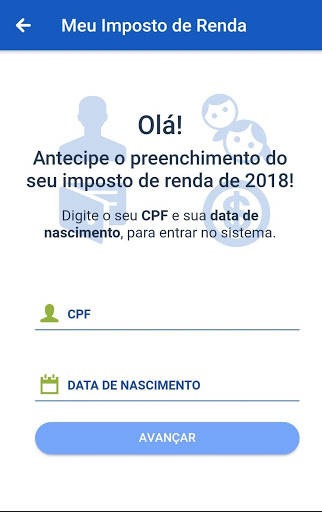

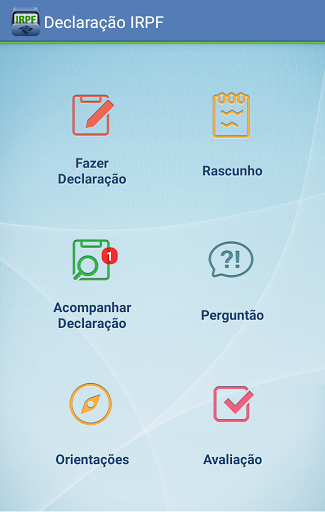

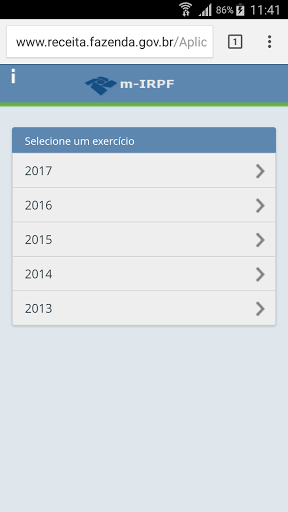

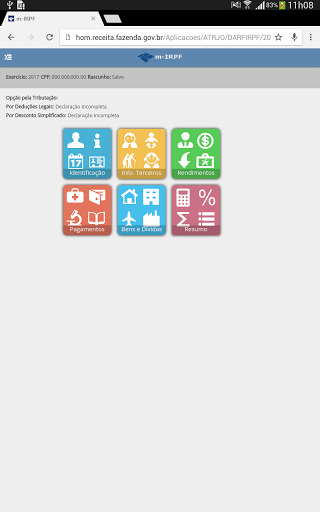

We expanded the possibilities of filling out the IRPF 2019 tax return:

On computers (PGP IRPF and online, using e-CAC).

On mobile devices, using the app for Android and iOS

The Follow Up Statement is not yet displaying information for 2019.

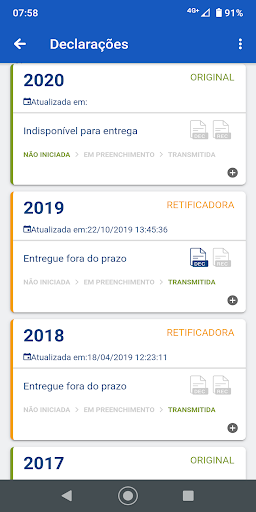

It is now possible to report accrued income (RRA) and to rectify statements provided by the IRPF Program, as long as the statement delivered does not contain information incompatible with My Income Tax.

Statements from previous years must be made by the IRPF Program.

It is available in e-CAC (rfb.gov.br), where you can change the keyword without having to inform the previous one.

For any problem: mobility.df@receita.fazenda.gov.br.

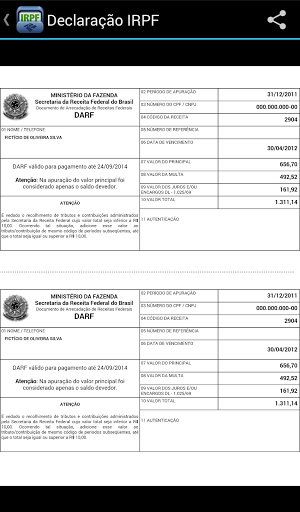

We make clear the option for automatic debit from the second share. The first quota will have to be paid with the DARF data.

We've solved the single-install bug with automatic debit.

We inhibit the functionality of DARF issuance when it is less than R $ 10.00.

Any problems, please contact mobility.df@fazenda.gov.br.

We corrected a few more JSON bugs with the help of users affected by this problem and made it simpler to clean up the statement still being filled. If you have already delivered, you do not need to rectify. Save the files of the declaration delivered for next year.

In this version, answering questions from some users, we have reestablished compatibility with devices Android 4.1 or higher. Please be advised that, in general, the app has a more stable performance with version 5.0 or higher of Android. If you have already submitted your statement, there is no need to rectify. Save the files of the declaration delivered for next year.

Bug fixes related to assets and debts, DV from the bank account, printing and downloading files from the statement. We will continue reading your comments. Thanks for the collaboration!

Some bugs that made it difficult to fill in were fixed, among them, which caused the automatic zeroing of the zeros to the left of the bank account.

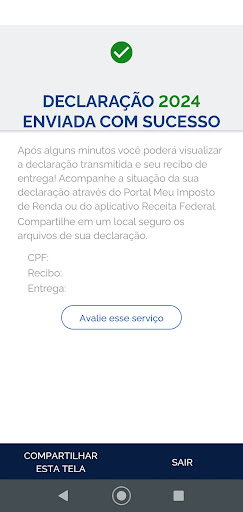

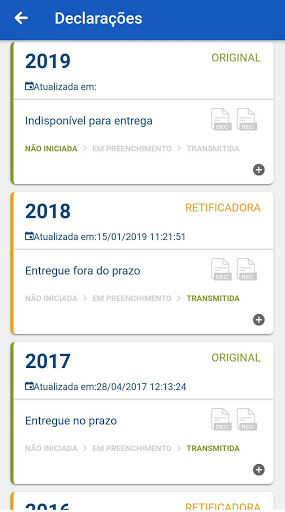

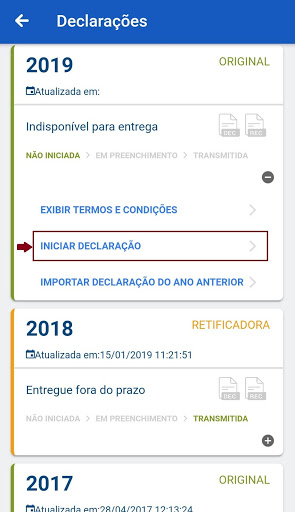

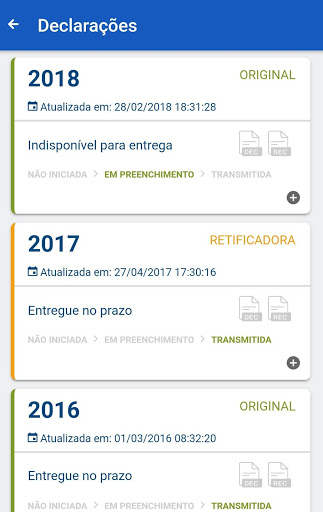

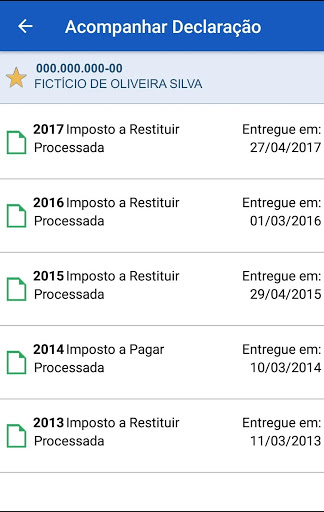

- delivery and rectification of the IRPF 2018 declaration with the possibility of taking advantage of 2017 information if the 2017 files (.DEC and REC) are saved on the device. - The application does NOT automatically download the statement files after the transmission. It is necessary to wait for the completion of the processes, which may take more than an hour. If the application informs you that the statement was delivered successfully, everything is right in the transmission.

Certificate update.

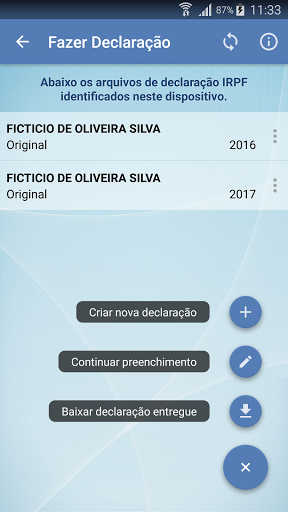

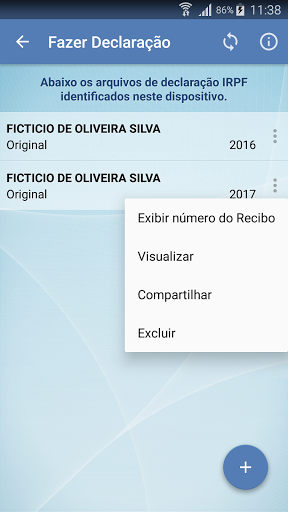

Implemented functionality to view the receipt number of the transmitted IRPF declaration. This amendment reaches the declarations of 2016 and 2017. It's possible: -do the original declaration from 2013 to 2017 -import data from your 2016 declaration (if the declaration DEC is in the device) to start the 2017 declaration - to import data reported in its 2017 Draft (for those who have already started preparing the 2017 declaration) to start the 2017 declaration.

Samsung Galaxy Grand Prime

Samsung Galaxy Grand Prime